Increased Auto Insurance Premiums Likely as Lines Face Pricing Pressures Head On

Insurance claims inflation has risen faster than the underlying consumer price index (CPI), outpacing auto insurance premium increases, according to a new study, Auto Insurance: The Uncertain Road Ahead, by the American Property Casualty Insurance Association (APCIA).

The national trade association for home, auto and business insurers added that the combination of rapidly increasing overall economic inflation and claims inflation has driven up auto insurance losses and combined ratios.

Miles driven hasn’t gone back to pre-pandemic numbers and is unlikely to do so, according to APCIA, due to high gas prices and continued work-from-home employer policies.

Despite less miles driven, U.S. private passenger vehicle damage claim severity (the average cost per claim for property damage liability and collision) increased nearly 50 percent from 2018 to 2022, the study found, impacted by rising auto repair and labor costs, inflation and theft rates.

Over the same period, average bodily injury claim severity increased 40 percent, reflecting an acceleration in medical inflation, legal system abuse and a sharp increase in deadly motor vehicle accidents, the report stated.

“In addition to inflation trends, the private passenger auto insurance sector is also experiencing several other trends, such as increased frequency and severity of claims cost, riskier driving behavior by the public, cost increases for medical and hospital services, and outsized growth in lawsuit verdicts and legal system abuses, that are negatively impacting and pressuring the industry with increased losses,” said Robert Passmore, department vice president for APCIA and co-author of the paper.

APCIA found that losses on underwriting in 2022 for private U.S. property/casualty insurers were $25.6 billion, more than double the losses in 2021 and the worst result since 2011.

The aggregate net worth of the U.S. property/casualty insurance industry — the financial cushion to absorb unexpectedly high claims costs, investment losses and catastrophe and weather events — fell by $73.1 billion in 2022. The 6.9 percent drop from year-end 2021 was the largest percentage decline since the “Great Recession” year of 2008, the study noted.

Individual lawsuit verdicts have increased substantially along all lines, the report found, “fueling lawsuit inflation.”

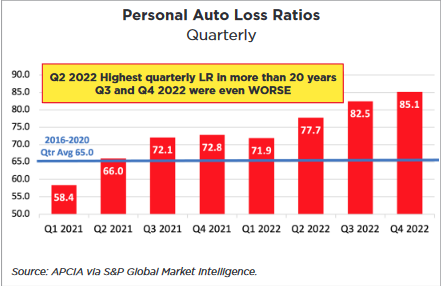

Private passenger auto insurance experienced the highest direct loss ratio among major lines of business at 80.2 percent (excluding loss adjustment expenses) in 2022, the analysis found, representing an increase of 12.2 points from 2021 and 24.1 points from 2020.

Personal auto premiums increased 6 percent for the year, “far below the 24 percent rate of escalating losses,” the report stated.

The study found that auto repair and maintenance costs rose 2 percent in June 2022, the largest increase in nearly fifty years. Vehicle complexity is one reason for the increased costs, the report added.

“All indicators suggest elevated auto repair and replacement costs will stretch well into 2023 and potentially beyond,” said Passmore. “Medical inflation is also accelerating. Although insurers continue to monitor the situation closely, as claim costs continue to rise, insurers may be forced to pass these loss costs along to policyholders. Given the trends, insurers are strongly encouraging drivers to minimize their risk by avoiding risky driving behaviors that may result in a loss. Insurers are also advocating for better infrastructure, including reliable supply chains for critical auto parts and safer roads, which should result in fewer accidents and lower claims costs that help keep insurance premiums affordable for consumers.”

Source: www.carriermanagement.com